What Type of Insurance Does Uber Have for Drivers?

Request Free ConsultationDoes Uber’s Insurance Policy Cover You as a Driver?

As personal injury attorneys we get a lot of questions from rideshare drivers about Uber and Lyft’s insurance coverage. “How does Uber’s insurance give me coverage?” “Will Uber’s policy cover my passengers or am I personally responsible?” “Do I need insurance if Uber has their own policy?” “Does Uber’s insurance only cover when I have passengers?” We’re here to answer these questions, and many others.

The Way Ridesharing Insurance Policies are Categorized

Insurance requirements fall under three different categories, or periods:

- Period 1: The first period covers the time when your app is on and you are waiting for a ride.

- Period 2: The second period covers the time between acceptance of a rideshare on the app and the passenger(s) getting in your vehicle.

- Period 3: The third period covers the time between the passenger(s) getting in your vehicle and exiting your vehicle.

With Uber, the coverage for these periods fall into two different categories:

- Category 1: The time when the Uber app is on and you’re waiting to be matched with a ride. (Period 1)

- Category 2: The time between accepting a ride and the passenger(s) exiting your vehicle. (Period 2 and 3)

Uber’s Insurance Coverage Under the Two Categories

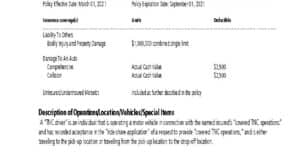

Uber has posted three different Certificates of Insurance on their website, in effect between March 1, 2021 and September 1, 2021. The first two policies give coverage for category 1 above. The third policy covers category 2.

Certificate One

Certificate Two

Certificate Three